As your trusted Massachusetts State Automobile Dealers Association technology resource, we’re thrilled to offer you educational opportunities so you can increase your IT knowledge and understanding.

Register Below for our MSADA Exclusive Webinar Series, Coffee With Coopsys!

*Registering allows you access to each webinar; no need to register for each event.

2024 Schedule of Events:

• May 14th: 7 Reasons Hackers Target Auto Dealerships (& How to Stay Safe)

• June 11th: Beyond FTC Safeguards: Navigating Cybersecurity Challenges That Threaten Automotive Dealers

• July: No webinar

• August: No webinar

• September 10th: Data Lockdown: Controlling Access to Your Data & how it’s transmitted

• October 8th: Driving Integrity: Implementing Vendor Due Diligence in the Automotive Industry

• November 12th: AI in Auto: Navigating the Road Ahead with Innovation and Caution

• December 10th: What is a CISO and Why Does My Dealership Need One?

Upon registration, you will receive an email link to the webinar series. . If you have any questions, please email [email protected].

Cooperative Systems delivers cutting-edge technology solutions to help dealerships transform their business, ensuring compliance and robust data security.

Looking for previous webinars?

Click on any of these options:

June 2024: Beyond FTC Safeguards: Navigating Cybersecurity Challenges That Threaten Automotive Dealers

May 2024: 7 Reasons Hackers Target Auto Dealerships (& How to Stay Safe)

December 2022: What The Looming FTC Compliance Regulations Means For Your Dealership

November 2022: Compliance: What your dealership needs to know!

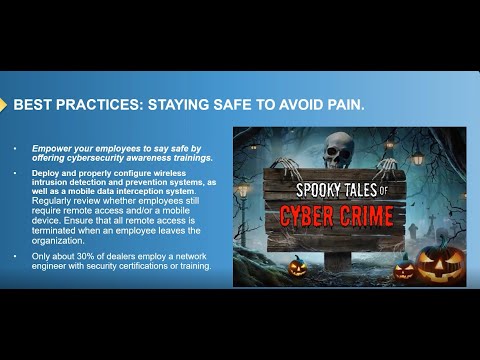

October 2022: Why Cybersecurity Does Not Have to Be Spooky

September 2022: The Danger of My Dealership NOT being Compliant with the new FTC

June 2022: Guaranteed protection against ransomware attack

May 2022: Are you sure your cybersecurity insurance policy covers you?

April 2022: We Love to Hate Downtime When Your Technology Fails to Work Properly

March 2022: Your Passwords are Compromised! (And You Probably Don't Know It!)

February 2022: The Seven Things Your IT Partner Does Not Want You To Know

January 2022: Bad IT Behaviors & Policies: 5 Bad Tech Behaviors That Cost You MONEY

December 2021: Microsoft Licensing Compliance & Office365 Subscription Plans

How to Manage a Proper PCI Compliance Program Within Your Dealership

IT Policies and Procedures Your Dealership Should Have in Place

Top 5 Ways You Can Protect Your Dealership from a Ransomware Attack

What is Cryptocurrency & How To Be Prepared To Accept It

Need auto retail specific managed IT Services?

Have a question?

Browse our FAQs for answers:

A: PCI is a set of security standards put in place 2006 to protect consumers’ credit card information. It mandates that all companies that accept, process, store or transmit credit card, debit card, and pre-paid cards information must maintain a secure environment to protect this data.

The PCI standards are managed by the Payment Card Industry Security Standard Council (PCI SSC), enforced by large payment card brands (American Express, Discover, JCB, MasterCard, and Visa International), and audited by qualified PCI auditors.

In addition, The Federal Trade Commission (FTC) is responsible for regulating consumer privacy and security. This means they could play an additional role in enforcing PCI violation penalties. Learn more here.

In general, PCI compliance is required by credit card companies to ensure that online transactions are secure and protected against identity theft. The current standards can be found here.

A: Every merchant that accepts client credit card payment and processes, stores, and transmits this data must be compliant. Even if you take credit card information over the phone, do not store the data, or work with third-party processors, you must still comply with PCI.

A: Compliance failure increases your risk of a security breach, which can lead to hefty penalties, fines, and loss of your merchant account. If you lose your merchant account, you will no longer be able to process credit card transactions and impact your profitability.

A: There are many costs, on top of PCI penalties, when your company experiences a data breach. According to SecurityMETRICS, these costs include:

- Merchant processor compromise fines: $5,000 – $50,000

- Forensic investigation: $12,000 – $100,000+

- Onsite QSA assessments following the breach: $20,000 – $100,000

- Free credit monitoring for affected individuals: $10-$30/card

- Card re-issuance penalties: $3 – $10 per card

- Breach notification costs: $2,000 – $5,000+

- Technology repairs: $2,000 - $10,000+

- Increased in monthly card processing fees

- Legal fees

- Civil judgments